Dutch healthcare real estate should be an integral part of any institutional real estate portfolio. Hartelt Fund Management substantiates the unique opportunities and characteristics, such as combining stable, inflation-indexed financial returns with high social impact.

Healthcare real estate has emerged over the past decade as a compelling and strategic segment within the real estate investment market. It has proven eminently suitable in the pursuit of diversification and capitalization on megatrends. Hartelt defines healthcare real estate as property leased to healthcare providers in the care and cure segments. Senior housing does not have the specific opportunities and characteristics of healthcare real estate and falls outside this definition because of its high correlation with the residential real estate market.

Demographic and social trends

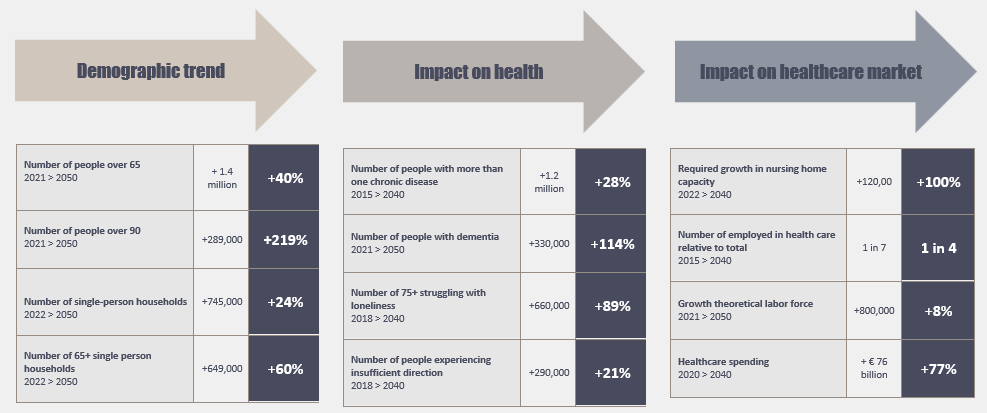

Demographic trends, such as a (double) aging population and increasing life expectancy, create a strong tailwind for healthcare real estate. The “double aging effect” (the group of elderly is growing, and the average age is increasing) in particular is driving demand for healthcare facilities and specialized medical services. These demographic trends are reinforced by social trends: changing consumer preferences, loneliness, living at home longer, the desire for greater self-direction, more active seniors, and the growth of single-person households. Figure 1 shows the implications of demographic trends and their impact on the health and care market.

Resilience and stability

One of the main reasons why Dutch healthcare real estate should be considered by institutional investors, is its inherent resilience and stability. Healthcare facilities such as nursing homes (with 24-hour care) and care and treatment centres provide essential services that cannot be outsourced and are virtually immune to economic cycles. Demand for healthcare services remains constant regardless of economic conditions, making healthcare real estate a defensive investment strategy during periods of market volatility. In addition, the aging population in the Netherlands contributes to continued and growing demand for healthcare services.

Government support and stable regulation

The Dutch healthcare system enjoys strong government support and stable regulation. The government’s commitment to maintaining a high level of healthcare and healthcare infrastructure creates a favourable environment for investors. Stable regulations reduce uncertainties related to changes in policy, providing a stable investment strategy for institutional portfolios.

‘The double aging population is driving demand for healthcare facilities and specialized medical services.’

Attractive risk-adjusted returns

Dutch healthcare real estate offers attractive risk-adjusted returns, especially compared to traditional commercial real estate segments, but also compared to residential real estate. The stability of indexed income streams, coupled with the predictable demand for healthcare, contributes to the defensive nature and lower level of risk compared to other real estate investments. In addition, long-term leases with financially stable Dutch healthcare providers provide a reliable and predictable income stream, which enhances the risk-return profile of healthcare real estate. The unique mix of stability and growth potential makes it an attractive strategy for institutional investors looking to optimize their risk-return profiles.

Social impact and ESG considerations

In addition to financial returns, an investment in healthcare real estate also contributes significantly to the well-being of society. Investments in healthcare real estate directly promote the availability, accessibility and affordability of essential health and medical services for improved and affordable public health outcomes. As people age, the prevalence of chronic conditions increases, leading to greater demand for long-term care and support. This results in increasing spending on health services, medications, and long-term care. Governments, health insurers and society as a whole face the challenge of managing these increasing costs in a sustainable manner.

Moreover, investments in Dutch healthcare real estate, after renovation or new construction, include sustainable properties and thus provide efficient and future-proof housing. This benefits healthcare providers and their clients/residents. Institutional investors who value ESG principles can use healthcare real estate to align their portfolios with sustainable development goals (SDGs). Hartelt emphasizes the following SDGs: 3 (good health and well-being), 11 (sustainable cities and communities) and 13 (climate action).

Including healthcare real estate in institutional portfolios also offers investors the opportunity to play a role in solving healthcare challenges. One example is the increasing tightness in the labour market. Currently, 1 in 7 people work in healthcare. Based on current trends, this number should rise to 1 in 4 by 2040. Obviously, the labour market cannot keep pace with this growing demand. Smartly designed buildings with efficient infrastructure and smart features contribute to efficient work processes and creating a healthy building that has a positive effect on attracting staff, informal caregivers and volunteers. By supporting the development and expansion of healthcare infrastructure, investors contribute to the accessibility and affordability of health and medical services.

Focus on the Dutch healthcare market

To have a real impact on the Dutch healthcare market, it is important to enter into long-term partnerships with Dutch parties. Here, the quality, availability, accessibility, and affordability of care should come first.

In summary, healthcare real estate not only offers compelling financial returns and solid risk-adjusted performance, but also aligns with broader social and sustainability goals. Investors who recognize and embrace this vision can not only expect stable financial returns, but also contribute meaningfully to the well-being of people with care needs, improved health sector sustainability, affordability of care and advancement of health care infrastructure.

Joep Munten

Managing Director